- Новини та Аналітика

- Емісії

- Акції

- Кредити

- ETF & Funds

- Календар

- Індекси

- Інструментарій

- API

Ви перебуваєте в режимі підказок Вимкнути

Глосарій

Rating scale

Категорія —

Кредитні рейтинги

A rating scale is a system by which a rating agency assesses a company’s ability to meet its financial obligations.

Rating scales can be national or international. The main difference between an international scale and a national scale is the consideration of country risk, which makes it possible to compare and contrast the credit ratings of companies from different countries. Moreover, even the most reliable company in the country will be assigned a credit rating no higher than the sovereign one. So, for example, if the rating agency S&P has assigned a sovereign rating to Brazil for several years at the level “BB-,” then the rating of the nation’s largest company Petrobras, which is controlled by the state, will be no higher than the rating of the country.

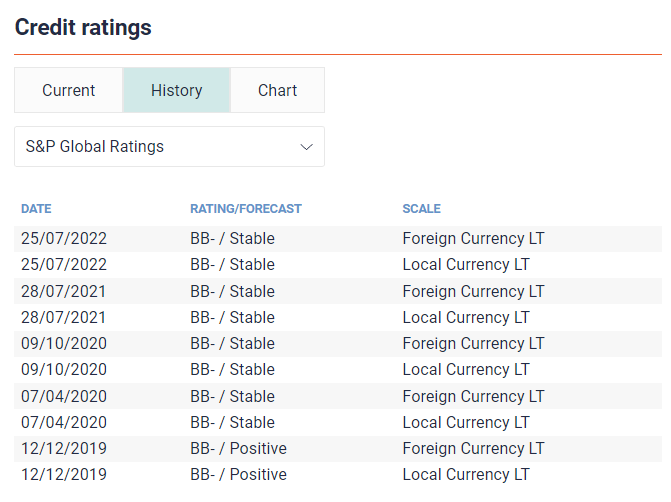

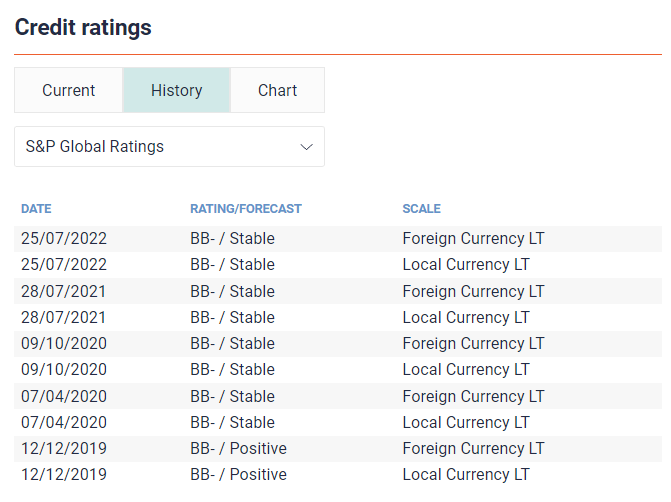

Credit rating of Brazil

Credit rating of Petrobras

The national scale does not take this risk into account, and, accordingly, the comparison of credit ratings is possible only within the state, that is, the creditworthiness of a rated entity can only be compared with other rated entities of the same country. The maximum national rating corresponds to the international rating assigned to the state.

In the vast majority of cases, both scales are identical to each other, except for the presence of a short country identifier in the name of the rating category on the rating scale, for example kz / kaz.

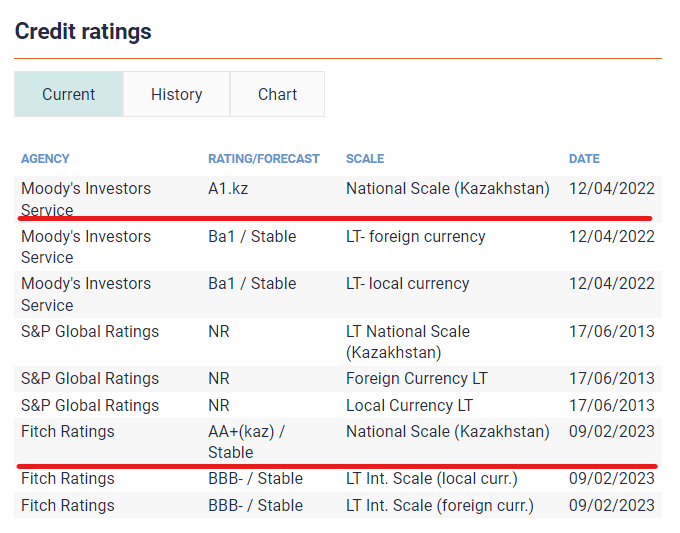

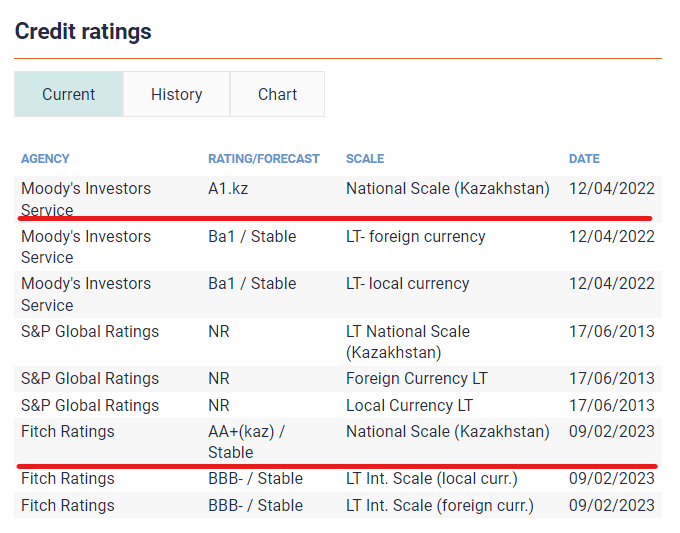

Thus, the rating agencies Moody’s Investors Service and Fitch Ratings assigned a long-term rating to the local bank Altyn Bank, based on the national scale of Kazakhstan.

Ratings on the international scale can be assigned both in foreign and national currencies. In the first case, the rating will give an understanding of the ability of the rated entity to meet its obligations denominated in foreign currency; that is, the risk associated with possible restrictions on the conversion to repay the issuer’s obligations denominated in a foreign currency will be taken into account. In the second case, the rating will give an understanding of the ability of the rated entity to meet its obligations denominated in the national currency.

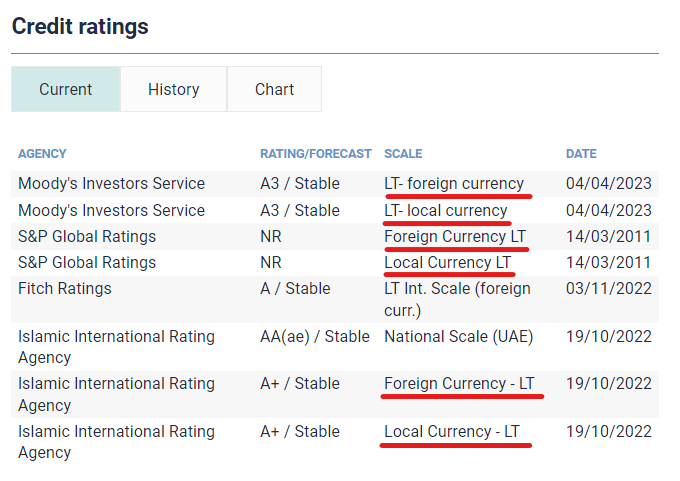

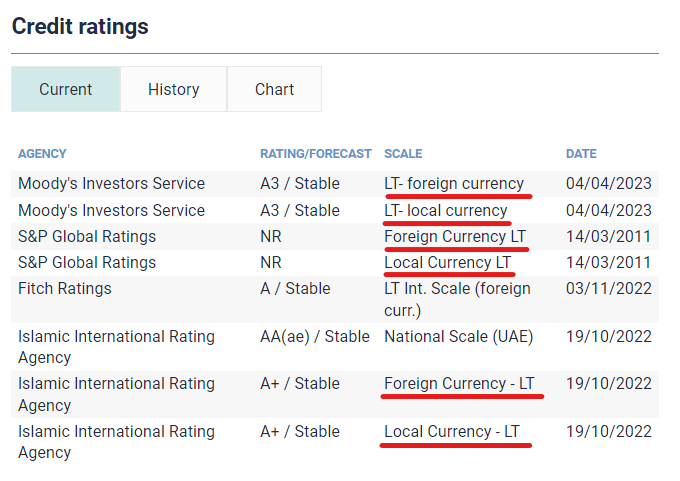

For example, rating agencies Moody’s Investors Service and S&P Global Ratings и Islamic International Rating Agency have assigned a long-term international rating in foreign currency and national currency to Dubai Islamic Bank.

Rating scales can be national or international. The main difference between an international scale and a national scale is the consideration of country risk, which makes it possible to compare and contrast the credit ratings of companies from different countries. Moreover, even the most reliable company in the country will be assigned a credit rating no higher than the sovereign one. So, for example, if the rating agency S&P has assigned a sovereign rating to Brazil for several years at the level “BB-,” then the rating of the nation’s largest company Petrobras, which is controlled by the state, will be no higher than the rating of the country.

Credit rating of Brazil

Credit rating of Petrobras

The national scale does not take this risk into account, and, accordingly, the comparison of credit ratings is possible only within the state, that is, the creditworthiness of a rated entity can only be compared with other rated entities of the same country. The maximum national rating corresponds to the international rating assigned to the state.

In the vast majority of cases, both scales are identical to each other, except for the presence of a short country identifier in the name of the rating category on the rating scale, for example kz / kaz.

Thus, the rating agencies Moody’s Investors Service and Fitch Ratings assigned a long-term rating to the local bank Altyn Bank, based on the national scale of Kazakhstan.

Ratings on the international scale can be assigned both in foreign and national currencies. In the first case, the rating will give an understanding of the ability of the rated entity to meet its obligations denominated in foreign currency; that is, the risk associated with possible restrictions on the conversion to repay the issuer’s obligations denominated in a foreign currency will be taken into account. In the second case, the rating will give an understanding of the ability of the rated entity to meet its obligations denominated in the national currency.

For example, rating agencies Moody’s Investors Service and S&P Global Ratings и Islamic International Rating Agency have assigned a long-term international rating in foreign currency and national currency to Dubai Islamic Bank.

Поділитися

вивчити найповнішу базу даних

800 000

облігацій у всьому світі

Більше 400

джерела цін

80 000

акцій

9 000

ETF

відстежуйте свій портфель найефективнішим способом

скринінг облігацій

Watchlist

Excel ADD-IN

Необхідно зареєструватися для отримання доступу.