- Новини та Аналітика

- Емісії

- Акції

- Кредити

- ETF & Funds

- Календар

- Індекси

- Інструментарій

- API

Ви перебуваєте в режимі підказок Вимкнути

Глосарій

Liabilities

Категорія —

Фінансова звітність

Liabilities are the existing responsibility of a company that arises from past events and whose resolution results in the outflow from the organization of resources containing economic benefits. This definition of liabilities is provided in IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

The issuer’s obligations are published as part of its financial (accounting) statements. In IFRS reporting, a company’s liabilities are disclosed as part of the statement of financial position. As part of reporting prepared according to local standards, for example, RAS, liabilities are presented in the organization’s balance sheet.

Liabilities, in addition to assets and equity, are some of the most important sections of the balance sheet that characterize the financial position of the company. They reflect all debt obligations of the issuer to creditors. Liabilities, along with capital, are one of the sources of financing for the company’s assets.

The maturity of the liabilities is divided into short-term (current) and long-term.

Short-term liabilities are understood as liabilities that must be repaid within one year of the date of their occurrence. They include accounts payable, short-term debt, taxes paid, and deferred income. At the same time, long-term liabilities are expected to be repaid later than 12 months and include long-term debt, long-term deferred income, and deferred tax liabilities.

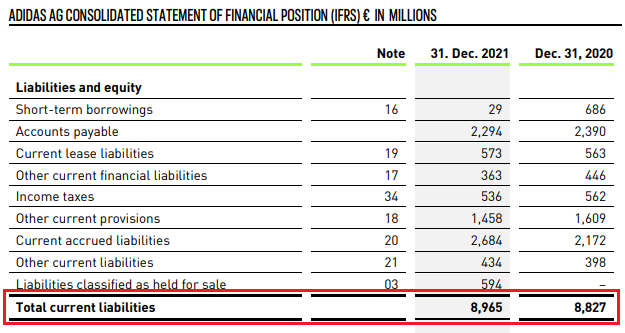

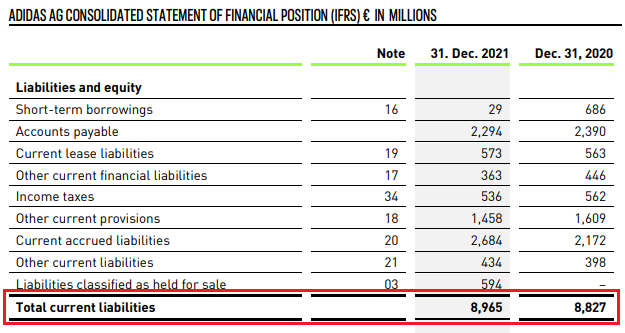

For example, at the end of 2021, the short-term liabilities of the German company Adidas amounted to EUR 8.965 billion, which is 1.56% higher than it was in 2020 when they amounted to EUR 8.827 billion.

The issuer’s liabilities are used to calculate various kinds of indicators, for example, absolute, urgent, and current liquidity ratios, debt ratio, and return on capital employed (ROCE).

Particular attention should be paid to short-term and long-term debt, which is reflected in the issuer’s liabilities and which is used to calculate a number of indicators, such as net debt and debt/EBITDA. Short-term and long-term debt include liabilities on issued debt securities (bonds, Eurobonds), loans and borrowing, leasing, derivatives, and dividend payments.

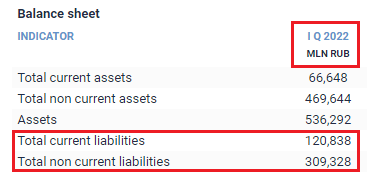

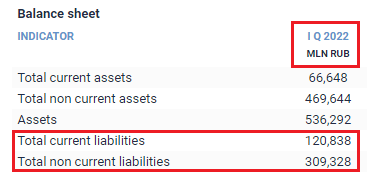

At the end of Q1 2022, Vimpelcom total borrowings on its issued bonds, according to IFRS, amounted to RUB 501 million, while as of December 31, 2021, it was RUB 712 million.

The issuer’s obligations are published as part of its financial (accounting) statements. In IFRS reporting, a company’s liabilities are disclosed as part of the statement of financial position. As part of reporting prepared according to local standards, for example, RAS, liabilities are presented in the organization’s balance sheet.

Liabilities, in addition to assets and equity, are some of the most important sections of the balance sheet that characterize the financial position of the company. They reflect all debt obligations of the issuer to creditors. Liabilities, along with capital, are one of the sources of financing for the company’s assets.

The maturity of the liabilities is divided into short-term (current) and long-term.

Short-term liabilities are understood as liabilities that must be repaid within one year of the date of their occurrence. They include accounts payable, short-term debt, taxes paid, and deferred income. At the same time, long-term liabilities are expected to be repaid later than 12 months and include long-term debt, long-term deferred income, and deferred tax liabilities.

For example, at the end of 2021, the short-term liabilities of the German company Adidas amounted to EUR 8.965 billion, which is 1.56% higher than it was in 2020 when they amounted to EUR 8.827 billion.

The issuer’s liabilities are used to calculate various kinds of indicators, for example, absolute, urgent, and current liquidity ratios, debt ratio, and return on capital employed (ROCE).

Particular attention should be paid to short-term and long-term debt, which is reflected in the issuer’s liabilities and which is used to calculate a number of indicators, such as net debt and debt/EBITDA. Short-term and long-term debt include liabilities on issued debt securities (bonds, Eurobonds), loans and borrowing, leasing, derivatives, and dividend payments.

At the end of Q1 2022, Vimpelcom total borrowings on its issued bonds, according to IFRS, amounted to RUB 501 million, while as of December 31, 2021, it was RUB 712 million.

Поділитися

вивчити найповнішу базу даних

800 000

облігацій у всьому світі

Більше 400

джерела цін

80 000

акцій

9 000

ETF

відстежуйте свій портфель найефективнішим способом

скринінг облігацій

Watchlist

Excel ADD-IN

Необхідно зареєструватися для отримання доступу.